Investment

Most banks pay little or no interest to their customers on their savings. Some banks even charge account management fees or negative interest. The stock exchange is a very safe alternative. However, if you put all your money into a few individual stocks, you risk high losses when prices fall. It is therefore better to spread your money widely across the entire market. However, this does not require the expensive purchase of countless stocks, but can be done from 10€ per month via savings plans on ETFs. ETFs are exchange-traded funds, i.e. ready-made packages with numerous stocks on specific topics that can be purchased cheaply.

Table of Contents

ETFs

Below is a selection of three large, slightly overlapping ETFs to help you invest your money as widely as possible in the global economy.

| Weight | Name | Region | Yield 1J1 | Yield 3J1 | Yield 5J1 |

|---|---|---|---|---|---|

| 12 | Lyxor Core MSCI World | Developed countries | +31.05% | +48.91% | +86.42%2 |

| 5 | Lyxor MSCI Emerging Markets Ex China | Emerging markets | +34.62% | ———— | ————— |

| 3 | Lyxor Core STOXX Europe 600 | Europe | +28.57% | +29.91% | +57.26% |

| ∑ | +31.57% | +45.11% | +80.59% |

pie title ETFs

"World" : 12

"EM" : 5

"Europe" : 3

Regions

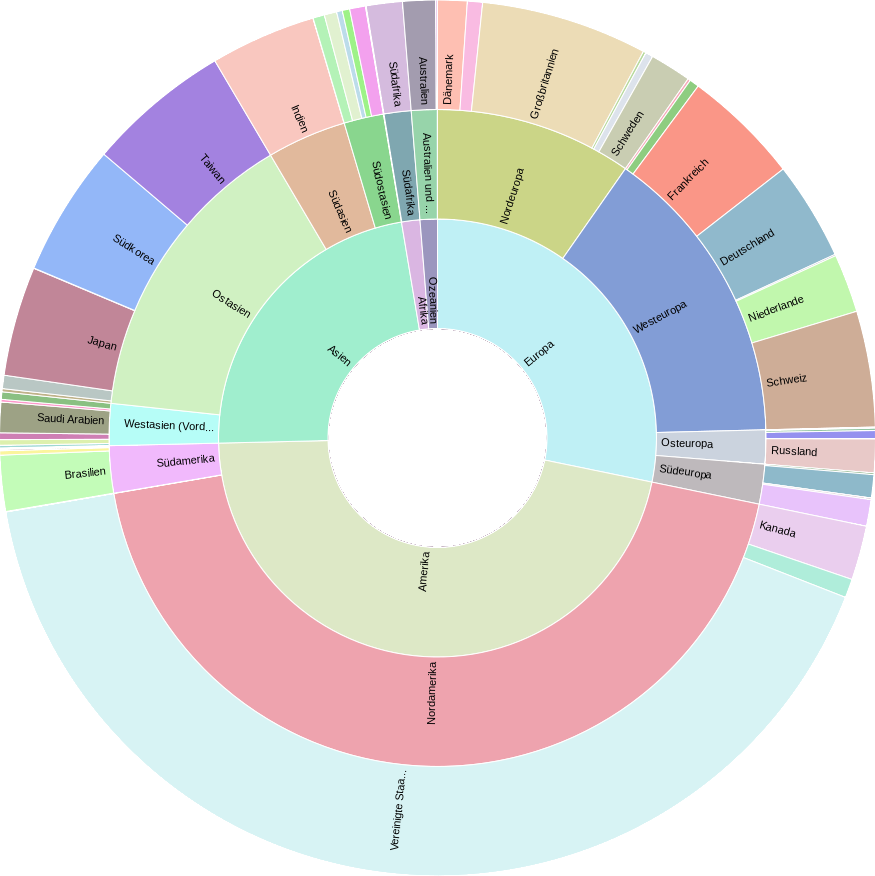

With the given weighting, the above ETF selection leads to the following distribution of the investment in the various regions of the world.

| USA | Asia | Europe | Other | Cash | |

|---|---|---|---|---|---|

| Lyxor Core MSCI World | 66.95% | 8.06% | 19.19% | 5.76% | 0.04% |

| Lyxor MSCI Emerging Markets Ex China | 0.29% | 66.27% | 7.74% | 25.64% | 0.06% |

| Lyxor Core STOXX Europe 600 | 1.40% | 0.27% | 97.93% | 0.20% | 0.20% |

| ∑ | 40.45% | 21.44% | 28.14% | 9.90% | 0.07% |

pie title Regionen

"USA" : 40.45

"Europe" : 28.14

"Asia" : 21.44

"Other" : 9.90

Details

Providers of an ETF must regularly buy shares in the companies included in accordance with their shares in the ETF. This creates costs for managing the ETFs. These costs are listed in the following table for the three selected ETFs.

| Name | ISIN | WKN | Costs/year |

|---|---|---|---|

| Lyxor Core MSCI World | LU1781541179 | LYX0YD | 0.12% |

| Lyxor MSCI Emerging Markets Ex China | LU2009202107 | LYX99G | 0.25% |

| Lyxor Core STOXX Europe 600 | LU0908500753 | LYX0Q0 | 0.07% |

Broker

Since an investor cannot place a buy or sell order directly on the stock exchange, a broker is necessary as an intermediary.

Trade Republic

The Trade Republic app can be used to create a savings plan from 10€ per installment, which can be used to purchase shares in selected ETFs free of charge. If you register via this invitation link, you will receive a credit of 15€ for the first transaction. Selling ETFs costs 1€ per ETF. Each additional trade also costs 1€.

Scalable Capital

A free savings plan is also possible via Scalable Capital, which can be used both on the computer via a web browser and an app. For every successful new registration via this invitation link, I receive 25€. The free version “Free Broker” from Scalable Capital is completely sufficient for a savings plan. The ETF selection is slightly smaller than at Trade Republic and a savings plan is only possible from 25€ per installment. You can do everything conveniently from your computer. However, if you want to trade a lot in stocks, ETFs or funds on a regular basis, you should invest 35.88€ per year in the “Prime Broker”. It is therefore worthwhile to compare the various offers before registering.

Shares

Buying stocks should always be a long-term and, above all, well-considered investment. Frequent transactions often result in high costs, which reduce returns or even lead to losses. A transaction should always be carried out with a limit or stop order, otherwise it is not entirely clear what prices are being traded at. (In the media, a woman is often cited as an example, who has amassed 360000€ in debt as a result.) Beginners should therefore not trade in stocks at all. ETFs are the better alternative because they are safe.